Structure with Confidence: Trust Foundations

Structure with Confidence: Trust Foundations

Blog Article

Reinforce Your Legacy With Expert Count On Foundation Solutions

Specialist trust foundation services supply a robust framework that can safeguard your properties and ensure your wishes are lugged out specifically as meant. As we dig right into the nuances of trust structure options, we discover the vital components that can fortify your heritage and provide a lasting impact for generations to come.

Benefits of Trust Structure Solutions

Trust fund foundation services provide a durable structure for safeguarding possessions and guaranteeing lasting financial protection for people and companies alike. One of the key advantages of count on structure options is possession defense.

Via counts on, people can detail exactly how their properties ought to be managed and dispersed upon their death. Trust funds also use privacy advantages, as assets held within a depend on are not subject to probate, which is a public and commonly prolonged lawful process.

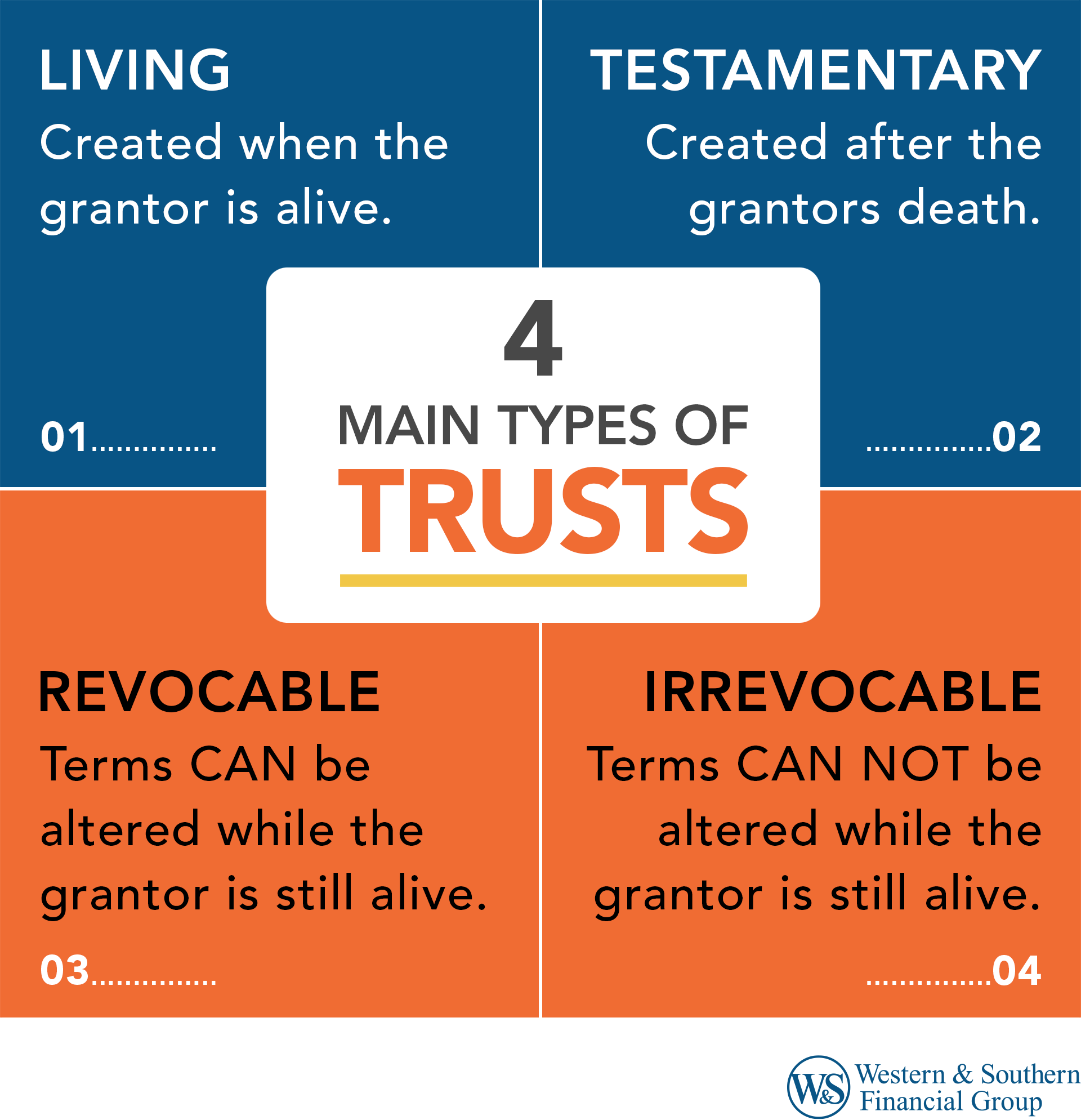

Types of Counts On for Tradition Planning

When taking into consideration legacy preparation, an important element involves checking out various sorts of lawful instruments developed to protect and distribute possessions successfully. One usual sort of trust fund used in heritage planning is a revocable living depend on. This trust fund permits individuals to maintain control over their assets during their lifetime while ensuring a smooth shift of these possessions to recipients upon their passing, avoiding the probate procedure and supplying privacy to the family members.

An additional kind is an unalterable count on, which can not be altered or revoked when established. This count on supplies prospective tax advantages and secures assets from financial institutions. Philanthropic trust funds are additionally popular for individuals aiming to support a cause while keeping a stream of income on their own or their beneficiaries. Special demands trusts are important for people with disabilities to ensure they obtain needed treatment and support without threatening federal government advantages.

Comprehending the various kinds of depends on available for tradition planning is critical in developing a thorough strategy that aligns with private goals and top priorities.

Selecting the Right Trustee

In the world of heritage planning, a crucial facet that demands mindful factor to consider is the selection of an appropriate individual to satisfy the essential duty of trustee. Selecting the appropriate trustee is a choice that can considerably affect the effective implementation of a trust fund and the satisfaction of the grantor's dreams. When selecting a trustee, it is vital to prioritize high qualities such as dependability, monetary acumen, stability, and a commitment to acting in the ideal rate of interests of the beneficiaries.

Preferably, the picked trustee needs to have a strong understanding of economic issues, be qualified of making audio investment decisions, and have the capability to navigate intricate legal and tax demands. By thoroughly taking into consideration these elements and selecting a trustee that lines up with the values and objectives of the trust, you can aid make certain the long-term success and preservation of your tradition.

Tax Implications and Benefits

Considering the financial landscape surrounding depend on structures and estate preparation, it is extremely important to explore the complex realm of tax obligation effects and benefits - trust foundations. When developing a trust fund, recognizing the tax implications is crucial for optimizing the benefits and minimizing potential obligations. Trusts offer various tax obligation benefits relying on their structure and function, such as reducing estate tax obligations, revenue tax obligations, and gift why not find out more tax obligations

One considerable benefit of certain count on frameworks is the capability to transfer properties to recipients with decreased tax consequences. Unalterable depends on can remove assets from the grantor's estate, possibly lowering estate tax obligation liability. Additionally, some counts on enable earnings to be dispersed to beneficiaries, who might remain in reduced tax brackets, leading to general tax financial savings for the family.

Nonetheless, it is necessary to keep in mind that tax obligation laws are intricate and conditional, emphasizing the necessity of speaking with tax professionals and estate planning experts to ensure compliance and make the most of the tax advantages of trust fund foundations. Appropriately navigating the tax obligation effects of trusts can cause substantial cost savings and a much more reliable transfer of wide range to future generations.

Actions to Establishing a Trust

To More about the author establish a trust effectively, meticulous focus to detail and adherence to legal protocols are critical. The very first step in establishing a depend on is to clearly define the objective of the trust fund and the Extra resources assets that will certainly be included. This entails recognizing the beneficiaries that will profit from the trust and assigning a reliable trustee to manage the possessions. Next, it is vital to select the type of trust that finest lines up with your objectives, whether it be a revocable trust, unalterable count on, or living trust fund.

Conclusion

In conclusion, establishing a trust fund structure can provide various benefits for legacy planning, consisting of property protection, control over circulation, and tax advantages. By selecting the ideal kind of trust fund and trustee, people can safeguard their possessions and guarantee their wishes are executed according to their desires. Recognizing the tax obligation effects and taking the required steps to establish a trust can aid strengthen your tradition for future generations.

Report this page